Refinance Housing Loan

There are more than tens of bank refinance packages that are available in Malaysia and everyone saying that they are offering the best. This is why you should hire us as your refinance consultant. We compare and propose the best possible refinance packages and solution.

Hassle-free refinancing, get approved in 14 days even if banks rejected your loan. We have proven strategy to regain your financial credibility and regain loan offer. The good news is our refinancing services can be adapted to business of any size, whether you need to refinance a condominium or a bungalow.

100% SAFE STRATEGY

We are well-known to be trustworthy and reliable. We protect the confidentiality and your money.

HIGHLY EXPERIENCED & TRUSTED

We have been in the field for more than 10 years. We are highly experienced and have a 99% of success rate in resolving refinancing issues.

NO HIDDEN CHARGES

All the costs will be provided clearly to your before you apply for the mortgage. We are transparent to every client.

SIMPLE AND EASY REFINANCING

No knowledge or experience? Just approach us, we provide you one-stop refinancing service, till your loan is approved.

BENEFITS OF REFINANCING YOUR HOUSE:

Many people choose mortgage refinancing to cash out for medical, renovation & etc, or replace the current house loan with a new loan to reduce the interest rate. You might want to do so as well because your current loan has higher interest, unaffordable anymore and especially when there are some beneficial loan terms available to you now.

Once you have your refinance loan approved, the new loan will pay off your current unwanted loan completely. Then, you would proceed to pay for the new loan until you have paid it off or you refinance it as well.

- Lower monthly payments for loans

- Pay off and settle the loan faster

- Settle blacklist issues in the bank and improve debt service ratio

- Get a cash-out refinance for other investments

- Restructure the debts

STEP BY STEP TO REFINANCE A HOUSE

1. Please Do Not Hesitate to Contact Us

Contact us and we’ll set up a zoom meeting or phone call to understand your objectives and current challenges.

For urgent enquiry, please call 012-572 0300 or click at the WhatsApp button to get an in-depth free one-to-one consultation session with Chu Yao, the mortgage loan consultant.

2. Understand the Situation You Are Facing & Advise On the Solutions

During the session, Chu Yao will share the steps and tips on how refinance can help to reduce your financial burden. We will require you to send documents in order to proceed for refinance loan application. We adopt the concept of “Effortless Financing Online”.

3. Recommend the Most Suitable Option & Submit for Loan Application

Upon analysis of the required documents, we will propose several available options from different banks for your consideration and recommend you the most suitable option for your unique situation. Further discussion may be required if needed.

Once you have agreed with the proposed solution, we will submit your application to the bank and closely following up to make things happen.

4. Loan Approved

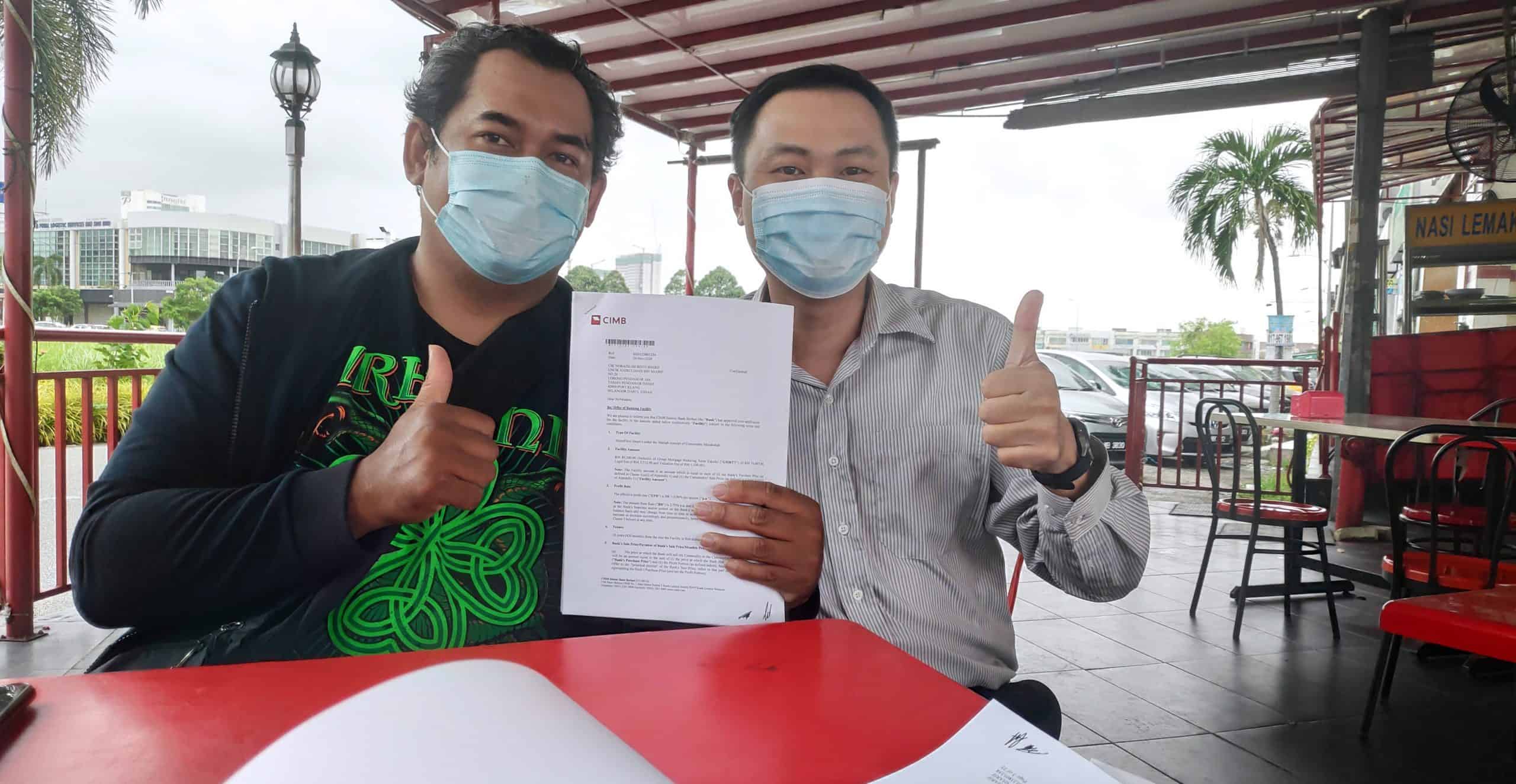

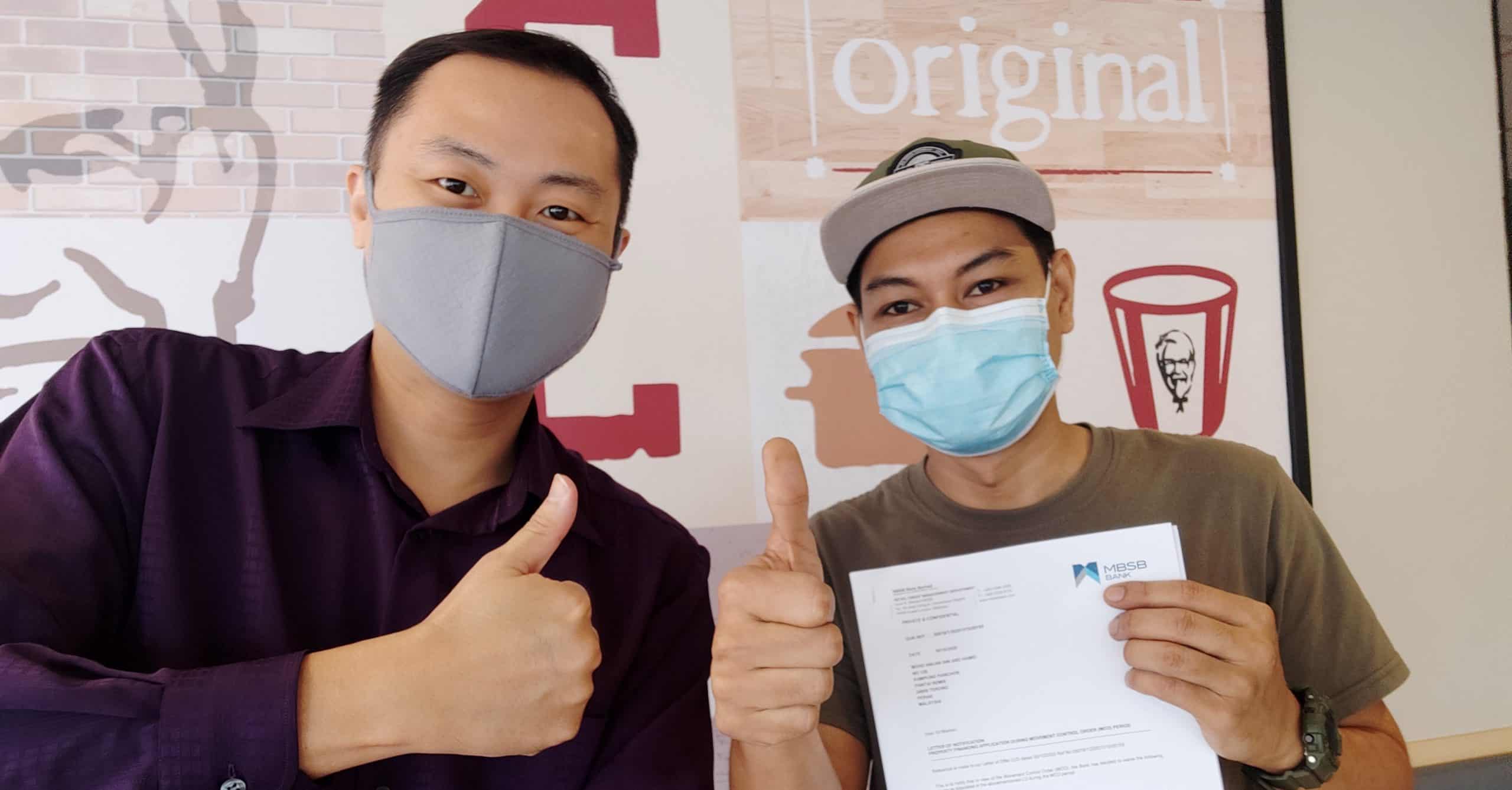

Upon approval from the bank, we will meet up and sign the Bank Loan Letter of Offer (Bank LO).

Our consultant will support you all the way even after getting the loan approval, until your fund is fully disbursed by bank. We look forward to establishing a fruitful and long-lasting business relationship with you.

MY HAPPY CLIENTS

All of them got approval for their mortgage loan and refinance loan, that they are happy with.

Click here to view video testimonials

Quick Contact